Biuro rachunkowe Poznań

Postaw na profesjonalizm – biuro rachunkowe RACHMISTRZ od lat oferuje działania związane z księgowością dla małych i średnich firm, dzięki czemu zyskało sobie zaufanie wśród wielu przedsiębiorców w całym Poznaniu. Posiadamy wieloletnie doświadczenie w rozliczaniach finansowych, a także w fachowym doradztwie, co pozwala nam na wybranie najlepszego dla Państwa rozwiązania, dopasowanego do wszystkich potrzeb Państwa firmy.

Usługi księgowe

Biuro Księgowe RACHMISTRZ Poznań specjalizuje się w obsłudze małych i średnich przedsiębiorstw w zakresie ewidencji księgowych, rozliczeń kadr i płac oraz doradztwa gospodarczego. Oprócz obsługi księgowej dla firm bierzemy udział w licznych szkoleniach w celu poszerzenia, udoskonalenia i unowocześnienia swojej wiedzy. Swoje umiejętności wykorzystujemy tylko i wyłącznie dla dobra Klienta i jego firmy. Cechujemy się wysoką jakością działań, komfortowymi warunkami współpracy oraz partnerskimi relacjami z Klientami.

Zachęcamy do przejrzenia szczegółowo oferty naszego biura rachunkowego w celu zaznajomienia się z naszymi kompetencjami i zakresem naszych działań rachunkowych:

Biuro rachunkowe

w Poznaniu

Uzyskaj darmową wycenę

Szukasz rzetelnego biura rachunkowego, znalazłeś się w dobrym miejscu. Uzyskaj od nas darmową wycenę. Działamy na terenie Poznania (Podolany, Jeżyce).

O Firmie

Celem Firmy Rachmistrz Spółka z ograniczoną odpowiedzialnością, która powstała w 1992 roku w Poznaniu Podolany, jest zapewnienie kompleksowej obsługi podmiotów gospodarczych obejmującej przede wszystkim księgowość, sprawy kadrowo-płacowe oraz doradztwo gospodarcze. Współpracujemy ze specjalistami z dziedziny finansów, prawa i podatków.

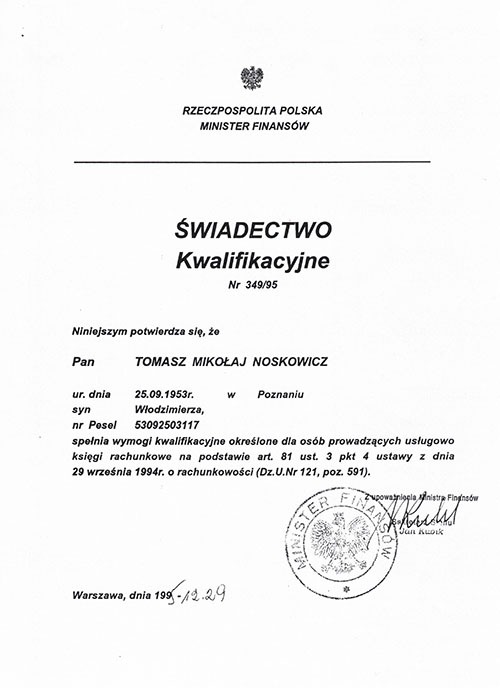

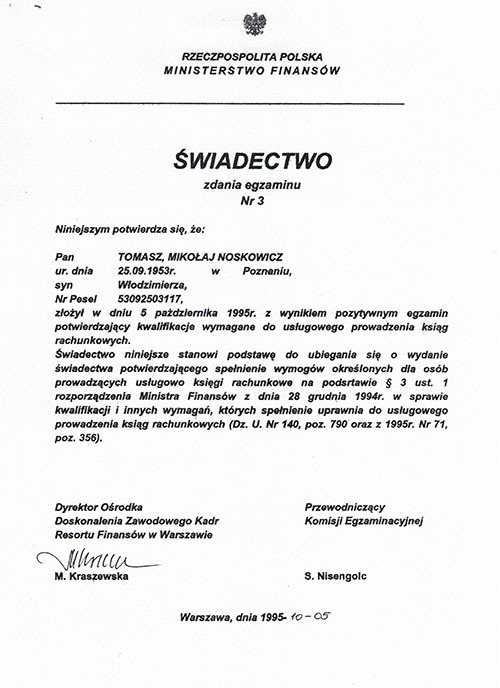

Rachmistrz to przede wszystkim zgrany i rzetelny zespół, który z pełnym profesjonalizmem i oddaniem stara się rzetelnie rozwiązywać problemy finansowe i podatkowe naszych Klientów. O kwalifikacjach i doświadczeniu personelu świadczą posiadane świadectwa kwalifikacyjne uprawniające do usługowego prowadzenia ksiąg rachunkowych nadane przez Ministra Finansów oraz uprawnienia biegłego sądowego w zakresie rachunkowości. Uczestnictwo w licznych szkoleniach i studiowanie literatury fachowej zapewnia pracownikom rozwój zawodowy. Mając świadomość zmieniających się przepisów, a także wymagań i oczekiwań przedsiębiorców małych i średnich firm, zawsze na bieżąco się staramy aktualizować swoją wiedzę, aby dostarczyć 100% satysfakcję z wykonywanych przez nas działań. Liczna grupa zaufanych i wiernych Klientów naszego biura rachunkowego jest tego wyraźnym przykładem. Jesteśmy gotowi na zawarcie współpracy każdego dnia – warunki są ustalane indywidualnie, na podstawie Państwa potrzeb.

Zawieranie z nami stałej współpracy wiąże się z pełnym zaufaniem. Posiadamy odpowiednią wiedzę i doświadczenie, czego dowodem są liczni klienci z poznańskich Jeżyc i Podolany. Możecie Państwo liczyć na naszą pomoc w każdej sytuacji – wystarczy zadzwonić lub napisać, a nawet odwiedzić nas w naszej siedzibie. Oddając swoje rachunki i finanse w nasze ręce, możecie mieć pewność, że zostaną właściwie przeliczone i zadbane. Od tego jesteśmy – aby Państwo skupili się na dalszym rozwoju swojej firmy, nie przejmując się kwestiami związanymi z podatkami czy innego rodzaju rachunkami.

Wśród Klientów naszego biura księgowego znajdują się spółki prawa handlowego i przedsiębiorcy będący osobami fizycznymi. Rachmistrz w Poznaniu świadczy działania na rzecz małych i średnich firm zarówno z udziałem kapitału polskiego, jak i zagranicznego, oferując obsługę także w językach angielskim i niemieckim. Chcąc zadbać o Państwa czas i możliwości rozwoju firmy, dokładamy wszelkich starań, aby współpraca przebiegała bezproblemowo i bezstresowo. Chwali się nasze biuro nie tylko ze względu na wysoki poziom usług rachunkowych, ale przede wszystkim za dobry, szybki kontakt oraz niezawodność działań.

Do osiągnięć spółki należy także zaliczyć stałe utrzymywanie swojej dobrej pozycji na rynku, coroczne przedłużanie umów przez naszych Klientów, którzy darzą nas zaufaniem, jak również pozytywne wyniki kontroli podatkowych i opinie biegłych rewidentów. Gwarantujemy, że współpraca z nami przyniesie Państwu same korzyści, w tym szansę na rozwój i wolność od zaprzątającej głowy papierkowej roboty. Rachunkowość to nie jest domena każdego, dlatego istnieją takie biura jak my, którzy są gotowi poświęcić się w pełni tymi ważnymi kwestiami, jednocześnie przynosząc ulgę właścicielom firm – zwłaszcza mniejszym i średnim.

Spółka zawarła umowę ubezpieczenia odpowiedzialności cywilnej z tytułu prowadzonej działalności.

Ewidencje są prowadzone przy pomocy programów: finansowo-księgowych oraz płacowo-kadrowych firmy Comarch.

RACHMISTRZ zaprasza

Dzięki współpracy z Firmą Rachmistrz uzyskacie Państwo:

- gwarancję poprawności prowadzonej księgowości,

- fachowe doradztwo,

- terminową realizację zleceń,

- oszczędność czasu,

- redukcję kosztów.

Zapraszamy do współpracy wszystkie małe i średnie firmy na terenie Poznania, zwłaszcza dzielnice Podolany i Jeżyce.

Jesteśmy niezawodnymi specjalistami, którzy współpracują z licznymi przedsiębiorcami w całym mieście. Zapewniamy komfortowe warunki współpracy, indywidualne podejście do każdej sprawy, bieżące doradztwo i pomoc w kwestiach finansowych, a przede wszystkim pełen profesjonalizm, rzetelność i niezawodność działań. Z nami Twoja firma może liczyć na fachową pomoc. Zachęcamy do zapoznania się z naszą pełną ofertą. Odzyskaj swój cenny czas – RACHMISTRZ zaprasza!